curve finance liquidity pool

Уникальные джекпоты в интернет-казино starda: забери огромный приз!

5 junio, 202510 Facts About Cabinet IQ That Will Instantly Put You in a Good Mood…

5 junio, 2025curve finance liquidity pool

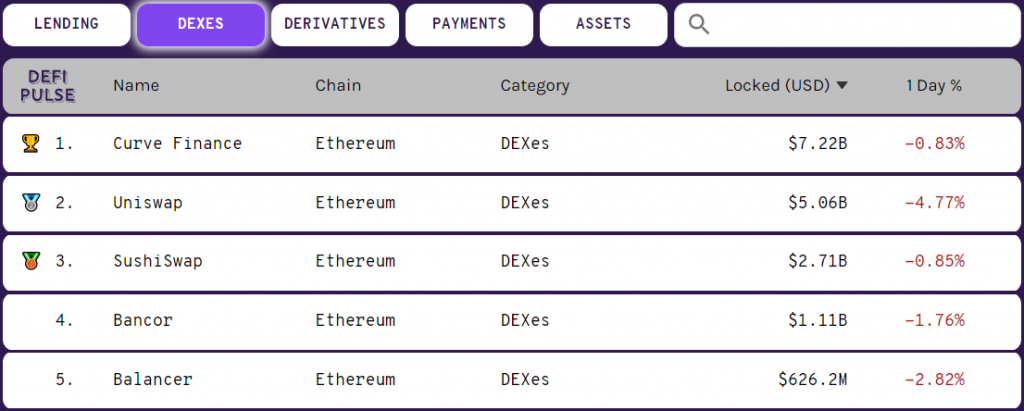

Curve Finance: Leading DeFi Liquidity and Stablecoin Protocol

Curve Finance is a decentralized exchange (DEX) optimized for stablecoin and low-volatility asset trading. Known for its efficient liquidity pools and low slippage, Curve has become a cornerstone in the DeFi ecosystem for stable asset swaps and liquidity provision.

Curve Fi

Curve Fi

Curve Fi refers to the platform’s core protocol that enables users to swap stablecoins and other similar assets with minimal slippage and low fees. It leverages specialized liquidity pools to facilitate efficient trading.

Curve Finance Crypto

Curve finance crypto encompasses the native tokens (such as CRV), liquidity provider tokens, and other assets within the Curve ecosystem. These tokens are used for governance, staking, and earning rewards.

Curve DeFi

Curve DeFi describes the broader decentralized finance ecosystem built around Curve’s liquidity pools and protocols. It includes yield farming, liquidity mining, and integrations with other DeFi platforms like Yearn, Convex, and more.

Curve Finance Liquidity Pool

A Curve liquidity pool is a smart contract that holds assets like stablecoins or similar tokens, allowing users to deposit and earn fees or rewards. These pools are optimized for low slippage and high efficiency, supporting large trading volumes.

Curve Finance Borrow

While primarily known for liquidity provision and swaps, Curve also supports borrowing mechanisms indirectly through integrations with lending protocols like Aave or Compound, where users can collateralize assets and borrow against their liquidity pool tokens.

Total Value Locked (TVL) in Curve represents the total assets deposited across all its pools. It is a key metric indicating the platform’s liquidity, popularity, and overall health within the DeFi ecosystem.